-

The company’s performance is analyzed by looking at how its turnover has developed since its stock market listing. The focus is on securities that have been able to increase their turnover year after year.

-

The company’s profit is also analyzed, following the same criteria as for turnover.

-

The continuity of dividend payments is examined. The stocks in the focus book have seen an increase in dividend payments every year since their issuance.

-

For stocks, the price is evaluated based on the ratio of profit, cash flow, and book value. This is used to determine how well the market value aligns with the company’s true value.

-

Both stocks and bonds must come from large international companies with high market capitalization.

-

The companies must be leaders or top-tier in their respective sectors.

-

They should have a presence in international and/or emerging markets.

-

They must have well-known brands and products (some companies’ names, like Novo Nordisk, may not be familiar to the general public, but the company is a leader in insulin production, so it is well known in its industry).

-

Stocks should outperform both the sector and the stock market.

-

Only investment-grade bonds are included, preferably with simple legal structures (traditional, high-credit-quality bonds).

-

ETFs are selected only from major issuers and include only main indexes.

-

Investment funds must have assets exceeding 500M EUR and be rated 4 or 5 by Morningstar.

-

The investment funds must consistently outperform their benchmark.

-

The fund must be managed by a large international asset manager.

-

The funds must have a long track record, at least 10 years.

Quality and diversification in customer portfolios

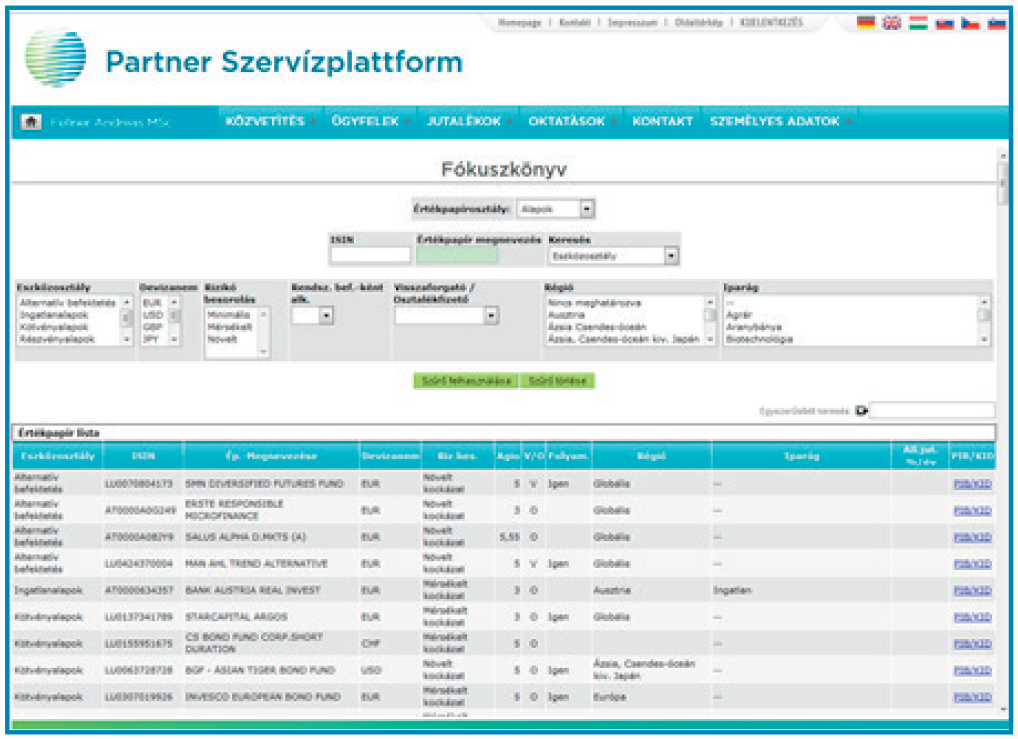

We are pleased to inform you that we can finally present to you our new Online Focus Book, available on the online partner platform!

With over 70,000 investment funds and more than 100,000 tradable stocks and bonds worldwide, it is certainly not easy to choose the best from the abundance of offerings and to continuously monitor them. To select the best from such a large pool of options, an entire Securities Research Department is required. This is precisely the reason we have put together our Focus Book based on specific selection criteria.

The most important selection criteria:

- Absolute and relative performance data

-

Independent rating

-

Volume and market capitalization

-

Chart techniques

-

Balance sheet and financial indicators

-

Classic quality traits, such as sustainability, market leadership, reputation

With the Focus Compendium, we aim to provide our sales partners with the full range of services from our Securities Research Department, making their work significantly easier and more efficient. Recent years have shown that many investment funds that were previously among the best have now significantly underperformed in terms of returns.

Deposit analysis indicates that client portfolios often no longer contain “Best in Class” investment funds, bonds, or stocks. As an independent bank, we feel it is our duty to position clients in such a way that they can always hold the best of the best in their portfolios.

The new Online Focus Compendium offers clients the opportunity to systematically present the best investment funds, ETFs, stocks, and bonds categorized by type. The current Client Information Document (KID) and Product Information Sheets (PIB) can be downloaded with a single click for the respective ISIN.

We are confident that with the Online Focus Compendium and Focus Book, we can provide a comprehensive service to support our intermediaries in their work.

Take advantage of the opportunity to review the contents of the portfolios with your clients. If possible, please ensure that the portfolio is divided into 10 to 20 different securities. For a successful and lasting business relationship with the client, we recommend that no more than 5-10% of the client’s total wealth should be allocated to a single position!

Wealth management, together with you!

Of course, we cannot leave out the wealth management products of our Bank. These will continue to serve as a solid foundation for clients who wish to benefit from our Securities Management wealth management, which is based on the best of the Fókusz compendium: Investment funds, stocks, bonds, and ETFs. This also includes the continuous management and oversight of the client’s assets.

For more information about the Fókusz compendium, please contact your Sales Manager or our Service Center colleagues!